Here are a few reasons how our taxi insurance helps you save your time and money-

In the present era, when you transact online, date online, stream videos online, why are you still buying insurance offline? Unlike traditional insurance policies, Reliance Taxi Insurance policy does things differently, which makes a significant difference for you!

- We have coverage for variety of situations

- Online policy issuance without any paperwork

- Our claim settlement process is simple and hassle-free

- We reward you for safe driving

- We offer end-to end online taxi insurance policy renewal

Important car insurance terms you should know-

Information is the key to make the right decisions. To ensure that you make an informed purchase, we have explained the essential car insurance concepts right here-

What is IDV?

The IDV (Insured Declared Value) is the current market value of the car which is calculated after deducting the depreciation amount. It is a crucial component of the car insurance policy as it determines the amount of compensation. In case of theft or total destruction of the car, the IDV is offered as "Sum Insured".

What is No Claim Bonus?

When you don't file a claim during your policy period, you will be eligible for a discount on your next premium which is referred to as a No-Claim Bonus. This discount will keep increasing progressively for each claim-free year until the car insurance premium is reduced up to 50%.

|

No. of Years |

Discount |

| One claim-free year | 20% |

| Two consecutive claim-free years | 25% |

| Three consecutive claim-free years | 35% |

| Four consecutive claim-free years | 45% |

| Five consecutive claim-free years | 50% |

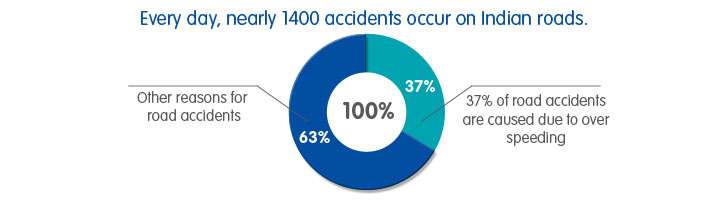

Not sure if you need car insurance? Numbers Don’t Lie!

The poor road conditions and a blatant disregard for traffic regulations make Indian roads one of the most dangerous in the world.

What does taxi insurance policy cover?

When you buy a taxi insurance policy, it is important for you to have the facts so you can make an informed decision. Having a knowledge of your coverage will help you avoid unanticipated expenses and provide you with maximum peace of mind. Have a look at the coverage offered with this policy-

a. Loss or damage to your vehicle due to:

- Riot, strike

- Earthquake

- Malicious act

- Inundation cyclone, hailstorm, frost

|

- Terrorist activity

- Landslide rockslide

- Accident (external means)

- Fire explosion, self-ignition or lightning

|

- Burglary, housebreaking, theft

- Flood, typhoon, hurricane, storm, tempest

|

b.

Third-party insurance, which protects you against losses that occur due to bodily injury or death to a third party or any damage to that person’s property by use of your insured vehicle.

What does taxi insurance policy not cover?

As much as we would like to cover all possible risks, certain situations are just not possible. We like to maintain absolute transparency with our customers. So here's what we don't cover in this taxi insurance policy-

- Loss or damage due to war or nuclear risks

- Deductible as stated in your policy

- Loss or damage due to ionizing radiation

- Vehicle driven by someone other than the driver, as stated in the 'Driver's Clause'.

- Accidental loss, damage or liability occurring outside the defined geographical area for the vehicle

- Vehicles being used other than in accordance with the limitations as to use. For example, if you use a private vehicle for commercial purposes.

- Consequential loss - if the original damage causes subsequent damage / loss, only the original damage will be covered.

T&C apply. For more details on risk factors, terms conditions, brochure, and exclusions, please read the policy wording and CIS carefully before concluding a sale. Details mentioned here are for the product- Reliance Commercial Vehicles Package Policy. UIN-IRDAN103RP0012V02100001.

**The number of garages mentioned is the total of all the garages empanelled across the country for different vehicle categories.